This article was published by The Eastafrican on 3 November 2014

Ethiopia, Kenya and Uganda are in the process of formulating their own broad tourism plans in an effort to implement the Inter-Governmental Authority on Development’s Sustainable Tourism Master Plan. Rwanda, which is not a member of the IGAD, is also keen to come up with a tourism blueprint alongside the regional block’s plan.

The states have been doing this with the support of the United Nations Economic Commission for Africa (UNECA) through its Sub-Regional office for Eastern Africa. UNECA is in the process of recruiting a substantive tourism officer to support the implementation of the Sustainable Master Plan for the IGAD Region, 2013 – 2023.

The IGAD master plan will provide member states with a regional framework for sustainable tourism development with a view to contributing to socio-economic development, poverty alleviation and to promoting regional integration.

Although each country was expected to domesticate many of the Plan’s provisions, they were given leeway to come up with plans that also fit into their own economic, social and infrastructure contexts

“Because there is no size that fits all, the domestication process will be context and country-specific depending on the state of maturity of the tourism sector in the country concerned, its endowments, state of its soft and hard infrastructure including human resources,” said Dr Geoffrey Manyara, head of the team of experts that co-ordinated the formulation of the tourism master plan.

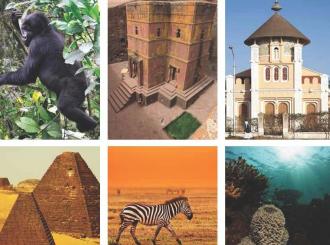

Ethiopia, the development of whose national tourism master plan is at an advanced stage, is expected to bank on its enviable ability to keep terrorists at bay as well as a significant cultural heritage as it develops its hospitality sector. Besides being ranked at position 33 globally in terms of cultural and heritage resources — which is above Egypt’s 39th position — Ethiopia is regarded as one of the safest countries in the world.

But for far too long, Addis has not been leveraging its comparative advantages. Consequently, it received a mere 550,000 tourists last year while Egypt has been getting a whopping nine million international tourists each year —even with the many political crises Cairo is facing.

But Ethiopia is finally shedding its passive approach to tourism development.

Dr Manyara said that, to capitalise on its comparative advantages, the country has launched the National Tourism Transformation Council that is chaired by Prime Minister, Hailemariam Desalegn, as well as the Ethiopian Tourism Organisation which is now charged with the development and marketing of the country’s tourism products.

In addition, Addis has identified, in two of its growth and transformation plans, tourism as a key growth sector.

The implementation of the 10-year master plan by individual IGAD members is the continuation of a process that began in 2010 when UNECA commissioned a study on the sector in East Africa. Among the study’s conclusions were the need for a regional brand identity and the creation of a unified approach to tourism development within IGAD.

Further, member states were urged to develop their respective tourism master plans and align them to the broader regional framework.

The regional plan was officially launched by President Uhuru Kenyatta last December during the IGAD Tourism Inter-Ministerial Forum held in Nairobi. During the occasion, Uhuru said that Africa’s share of the global tourism industry stood at 52.4 million or 5.1 per cent of international arrivals, which translated to $33.6 billion or 3.1 per cent of international tourism revenue.

Intra-regional tourism

The drafting of the plans comes at a time when tourism in East Africa has taken a severe thrashing following heightened terrorist activity in the region. Compounding this has been a reluctance by national marketing agencies to acknowledge changing global trends in their marketing strategies and to develop alternative investment and diversification options.

Until very recently, when Kenya began to champion a more robust regional economic diplomacy, bodies such as the Kenya Tourist Board (KTB) continued to give intra-regional tourism a wide berth even though it constitutes the biggest market for various destinations.

Indeed, regional tourism far outweighs the European or the American tourism market. This is authenticated by data from the UN World Tourism Organisation which demonstrates that African tourists form the largest segment of the tourists arriving on in the continent.

For instance, in 2009, regional visitors accounted for 46 per cent of tourist arrivals on Africa, compared with 31 per cent from Europe, 4 per cent from the Middle East, 3 per cent from Asia-Pacific and America.

“Despite the changing trends in domestic, regional and global markets, there is still a tendency, not just within the IGAD region, but (in) Africa as a whole, to concentrate marketing efforts and resources in the traditional Western European market” says the Sustainable Tourism Master Plan.

To Dr Manyara, this scenario is partly due to foreign domination in many aspects of the sector with the exception of the hotel sub-sector, where such domination has diminished significantly.

Still, IGAD member countries have not been organising regional tourism fairs like the World Travel Market conducted in Britain. Dr Manyara attributes this to the colonial legacy. Nevertheless, some regional marketing bodies are organising fairs such as Indaba in South Africa. KTB is also said to be planning a tourism fair in Kenya.

It is expected that IGAD members will attempt to capitalise on the expanded, but ignored regional market. But how well they fare in this regard, may depend on how far they develop what the IGAD master plan calls “appropriate products.” This will aid in tapping into not just the emerging Asia-Pacific market, but more importantly, the African regional tourist market.

This recommendation is in line with emerging hospitality trends that show that Europe as a source market for tourists is declining in importance.

Indeed, data posted in the master plan shows us that in future, the Chinese market will constitute a large share of the global source market and that although for now the share of the African and Middle East market is relatively small, they are considered the fastest growing markets at 6.2% and 9.9%, respectively.

Nature-based tourism

Tourism experts say that global trends suggest that 80% of the international tourists travel within their regions while the top global destinations are driven by strong domestic tourism demand. “This is a growing trend in Africa and the challenge for the IGAD region is to develop appropriate products to tap into the respective domestic and regional tourist markets.”

As they come up with their own plans, it would be interesting to see how the IGAD member countries adhere to the caution raised in the bloc’s blueprint against over-reliance on nature-based tourism. Among the alternative tourism products suggested in the regional plan are health tourism and gastro-tourism.

They also include tourism based on cultural resources, the region’s heritage, and more importantly contemporary culture or urban tourism — sports tourism, entertainment — or those products that would make a Kenyan tourist want to visit Ethiopia.

“The idea really is to shift from the traditional approach to tourism development in Africa where the focus is on nature-based tourism targeting mainly Western clientele, to one that is innovative and people-centred,” said Dr Manyara.

However, this recommendation flies in the face of critics who say that the new tourism products suggested by those who formulated the IGAD Master Plan — particularly health tourism and gastro-tourism — are somewhat ‘alien’ to the region but that their full development would require raising the level of IGAD’s economic and social development to a level that which may not have been attained by 2023.

“I think there is a misconception here that these are ‘alien’; if you look at Kenya for instance, we are benefiting from what you could call Ugandan health tourists.” Dr Manyara said, adding, “only problem is that the critics do not consider these as potential products because we have not yet packaged them well.”

But whether the regional plan or the individual member countries’ plans will succeed in bringing about significant development in the sector largely depends on how member countries create a safe and secure environment for visitors.

The IGAD region is reputed to be one of the highest risk regions in the world. Indeed, the Political Instability Index of the Economist Intelligence Unit ranks member countries as mainly high risk with the exception of Ethiopia which is considered to be of moderate risk.

Although the index is a mere perception of insecurity, the team that drafted the Master Plan say that the region has in actual fact been afflicted by various conflicts over natural resources while the proliferation of small arms and light weapons has also turned the region into one with the highest stockpiles of arms globally.

“Owing to the prevailing situation of instability in Somalia and the rise of piracy in the Indian Ocean, the once thriving cruise tourism has almost totally collapsed,” said Dr Manyara.

In as much as safety is concerned, IGAD is doing equally badly. For instance, the Travel and Tourism Competitiveness Index that takes into account four parameters — business costs of terrorism; reliability of police services; business costs of crime and violence; and road traffic accidents — to rank countries, places Ethiopia at position 102; Uganda at 117 and Kenya among the bottom countries globally at position 139.

This article was published by The Eastafrican and was posted on 3 November 2014 to the following link: